Financial Aid Disbursement

Disbursement Options

Please follow these steps to make a Refund Selection.

Get Started

- Go to our Refund Selection website

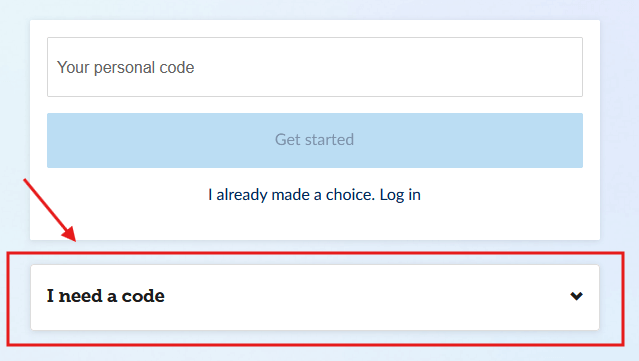

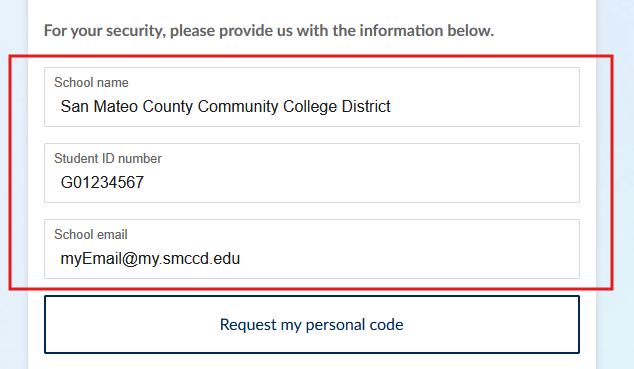

- Select "I Need a Code" and fill in the information.

- For School Name, input San Mateo County Community College District

- For Student ID number, use your G#. Make sure to enter the letter 'G' in your G#

- For the DOB + last 4 digits of your G#, use the format MMDDYY followed by 4 G# digits. Do not include symbols or spaces. Example: My birthday is August 7th 2001 and my last 4 digits of G# are 9876 → I enter 0807019876.

- After you receive the personal code to your email, continue making your selection.

Make a Selection

When it comes to deciding how to get your money, you deserve choices. Your choices include:

- Electronic Deposit to your Bank Account

Money is transferred to your bank account the same business day BMTX, Inc. receives funds from your school. Typically, it takes 1-2 business days for the receiving bank to credit the money to your account. - Electronic Deposit to a BMTX, Inc. Vibe Account

If you open a BMTX, Inc. Vibe account (upon identity verification), money is deposited the same business day BMTX, Inc. receives funds from your school. - Check

If you decide not to have your funds deposited electronically, you will receive a check in the mail.

Students with pending financial aid or scholarship refunds will receive a personal code in the mail via a green envelope or in an email from BMTX, Inc. Students may also request a personal code directly through the BMTX, Inc. site. The personal code allows you to sign up for one of two electronic options to deposit your money - either direct deposit to your existing bank account or to a BMTX, Inc. VIBE Checking Account.

Please Note: If prompted to enter your school name, use San Mateo County Community College District. We are enrolled with BMTX, Inc. as a college district, not as three separate colleges.

Terms of Agreement

For additional information, view our third-party servicer contract for refund management.

Disbursement Process

All financial aid funds are disbursed on scheduled dates each term.The enrollment status of students for financial aid awarding and disbursement purposes is finalized at the census date of the semester, noted on the college’s academic calendar. At that time, the actual amount of federal and state grants is determined per student. Courses added after census are not counted.

As long as students are enrolled in an eligible program and their financial aid file is complete, students will receive two disbursements of Federal Grant aid each semester, based on their enrollment level at census date (date varies by semester) and classes actively in session. If students are enrolled in a late start class, it will be paid when their attendance begins. Students enrolled in late start classes may initially receive less funds than their enrolled units but will receive additional disbursements as the late start class begins.

- Federal Grant Aid includes Pell Grant and Supplemental Educational Opportunity Grant

- Federal Direct Loans are also disbursed in two payments based on the approved loan

period

- Direct Loans are not disbursed for late-start classes until the student is enrolled and attending at least six units of coursework required for their program of study.

- Cal Grant and Student Success Completion Grant (SSCG) funds are one disbursement after census.

Deduction of Fees

All disbursed financial aid such as grants, federal student loans and scholarships will be first applied towards current institutional fees. These are fees owed to Cañada College, College of San Mateo or Skyline College such as enrollment fees, health fees and non-resident tuition. Once all institutional fees are paid, the remaining eligible balance will be disbursed to the student.

Student Refunds

The San Mateo County Community College District (SMCCCD) delivers your financial aid and scholarship refund with BankMobile Disbursements, a technology solution, powered by BMTX, Inc. Consider your Refund Choices.

Please Note: Students who have selected to deposit their refund into an exisiting bank account or into a Vibe bank account should expect to see their refund 7 -10 days after the disbursement amount moves from the "Expected Amount" to the "Paid To Date" column. Other refund methods may be delayed an additional 2-3 weeks.

Fall 2025, Spring 2026, Summer 2026 Disbursement Schedule

| Fund | Fall 2025 | Spring 2026 | Summer 2026 |

|---|---|---|---|

| SMCCCD Scholarships | July 31, 2025 | January 2, 2026 | Not Applicable |

|

Pell Grant and SEOG |

First half: August 8, 2025 Second half: Sept. 5, 2025 |

First half: January 9, 2026 Second half: February 6, 2026 |

First half: June 4, 2026 Second half: June 18, 2026 |

| Cal Grant and SSCG | September 5, 2025 | February 6, 2026 | Not Applicable |

|

Direct Loans* - Full Year Loan Period |

August 8, 2025 | January 9, 2026 | June 4, 2026 |

| Direct Loan* - One Semester Loan Period | Fall Only Loan: August 8, 2025 October 17, 2025 |

Spring Only Loan: January 9, 2026 March 20, 2026 |

Summer Only Loan: June 4, 2026 July 9, 2026 |

*Disbursement does not mean refund. Disbursement means we send the funds to BankMobile for further processing. Please expect the refund to arrive in your account via direct deposit or BM checking account assuming you set your BankMobile refund preference within two weeks of the dates listed in the table above.

*Census Day is the date which locks in your number of units for financial aid eligibility considerations.

- Fall 2025 Census: 9/2/2025

- Spring 2026 Census: 2/2/26

- Summer 2026 Census: 6/16/26

*Direct Loan Note: All first-time borrowers will be subject to a 30-day delay on their first loan disbursement. The 30-day period begins on the first day of the term, not of the loan application or approval date.

2025-2026 Loan Application Deadlines:

| Term | Last Day to Submit |

|---|---|

| Full-Year Fall 2025 | Spring 2026 semesters: April 25, 2026 |

| Fall 2025 only | November 18, 2025 |

| Spring 2026 only | April 25, 2026 |

| Summer 2026 only | July 3, 2026 |

Note: To be considered for a full-year loan in the spring term, you must have 1) completed 6 or more degree–applicable units during the fall and 2) be in good student academic progress (SAP) standing.

All loan requests require:

- a copy of your current valid government issued ID

- a Comprehensive Student Educational Plan (SEP)

- the completed form

Loan Proration Policy:

Get more information regarding Loan Forgiveness.